Your help is needed to make change happen.

What is the FairTax®?

That’s a good question. You’ll find a wide range of misinformation on the internet and in newspapers and magazines about what the FairTax is and what the FairTax isn’t. Our job at GFFT (Georgians For Fair Taxation) is to educate the public, so that each person can make an informed decision about the FairTax. We need your help to spread the word, but first, you’ve got to know the facts about the FairTax.

Just the Basics..

The FairTax replaces all federal income and payroll-based taxes by implementing a progressive national retail sales tax. Sound economic research shows this will reinvigorate the economy while providing some much needed economic stability. That’s why the FairTax also includes a prebate to make sure no one pays federal taxes on spending up to the poverty level. Best of all, the government still receives the money it needs to function. It just gets that money from the national retail sales tax, not your paycheck.

It’s nonpartisan!

Given the current tension in the political landscape as of late, it is important to understand that the FairTax is nonpartisan legislation. It is not the brainchild of Republicans, Democrats, Libertarians, or any other political party. The FairTax was born of American innovation and the belief that there is a better way to fund the federal government. The FairTax represents economic freedom for every American, no matter what political beliefs each may hold.

How does it affect the tax system?

In an unprecedented move toward real tax reform, the FairTax abolishes all federal personal and corporate income taxes. It also eliminates the gift, estate, capital gains, and alternative minimum taxes. Going a step further, the FairTax considers seniors and retirees by eliminating taxes on Social Security and Medicare. And if you are your own boss, you’ll take comfort in knowing the FairTax eliminates self-employment taxes, too. The Fair Tax Act removes most obstacles to economic prosperity and replaces them with one simple, visible, federal retail sales tax, a tax administered primarily by existing state sales tax authorities.

The FairTax is the single best option for real tax reform. Through the FairTax, we are taxed only on what we choose to spend on new goods or services, not on what we earn. That gives each of us the power to control our own financial future. To put it simply, the FairTax is the solution to the frustration and inequality of our current income tax .

A Deeper Look at the FairTax®

The FairTax plan is a comprehensive proposal that replaces all federal income and payroll-based taxes with a progressive national retail sales tax. Under the FairTax, we will be taxed on the goods or services we purchase and not on the income we earn. This tax strategy offers a fair and efficient solution that replaces the inequities of our current tax system. This nonpartisan legislation (HR 25/S 155) abolishes all federal personal income taxes (including capital gains and alternative minimum taxes), Social Security taxes, Medicare taxes, self-employment taxes, gift and estate taxes, and corporate income taxes. Existing state sales tax authorities will administer the system and will retain 0.25% of the money collected to offset their administrative costs. With tax collection policies and procedures managed by state and local government officials, the need for the IRS will be eliminated.

The use of a tax prebate will ensure no American pays federal taxes on spending up to the poverty level. The FairTax will provide dollar-for-dollar federal revenue replacement to fully fund our current government programs. Through companion legislation, the 16th Amendment to the Constitution will be repealed.

The 16th Amendment: The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several states, and without regard to any census or enumeration.

Our current tax system is broken.

It is unfair, complicated, and impossible for the average American to understand. The existing tax system is used as a tool to influence policy and political outcomes. With over 73,000 pages of tax policy, the complexity of this legal requirement is expensive, inefficient, and in many cases not fairly applied among individual citizens. The FairTax is a simple, fair, and transparent solution designed to replace the complexity of our current tax system. The FairTax legislation will create a tax policy that treats all citizens equally and allows American businesses to thrive, while providing a revenue-neutral solution ensuring that the current obligations of the government will be met.

You will keep your entire paycheck!

You will keep your entire paycheck!

The FairTax establishes a national retail sales tax of 23% charged on the purchase of new goods and services. This alternative system allows you to keep your entire paycheck and only pay taxes on the new products and services you purchase in a free market economy. The FairTax solution treats every individual equally, is pro-business, and will generate the necessary tax revenue without a four-million-word tax code. Under the FairTax, every individual living in the United States will pay a share of the tax based on a fixed sales tax rate, excluding necessary prebates to support a safety net for those of lower income.

The FairTax solution is the only current tax alternative that proposes the removal of the payroll tax.

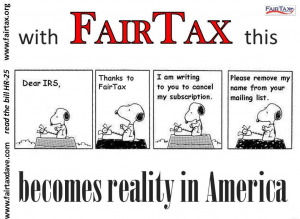

The FairTax plan understands that your earnings belong to you, the worker, the citizen. Therefore, you have the right to decide how to utilize or spend your resources. Under current tax policies, the Federal Government controls how much of your income you are allowed to keep. The IRS, the most feared Government entity, is the policing mechanism that ensures these tax policies are followed. The FairTax offers freedom from the IRS and freedom that allows individuals the right to control their finances to best meet the needs of their families and local communities.

Want to join the movement?

Learn more about what you can do to support the FairTax movement in Georgia.