Georgia for FairTax is working on legislation to keep Georgia competitive …

In a May 1, 2014 article in the Washington Examiner, political analyst Michael Barone wrote that recently released IRS data show that taxpayers are actively moving to states with lower or no income taxes. Those high-tax states that are losing residents are also losing their tax base. Eventually they will have to cut services or raise taxes on the remaining taxpayers.

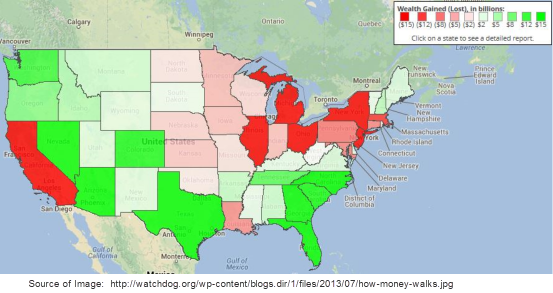

Data released by the IRS for the years 2010 and 2011 show that high-tax states such as New York, Illinois, New Jersey, and California have lost residents who had billions of dollars in taxpayer income. The adjusted gross income of taxpayers that left these four states alone totaled about $8 billion. Whereas Florida and Texas, which have no state income tax, have gained residents with about $7 billion in adjusted gross income! Georgia had a just small net increase in the income of new residents – a mere 3% of the amount that Florida had.

According to an April 29, 2014 article by Jim Pruitt in Human Events, eight of the nine states that have no state income tax saw a net increase in new residents’ incomes. Clearly taxpayers are voting with their feet. They have a choice when it comes to state income taxes, and they are choosing to lower or eliminate those taxes by moving.

Georgians for FairTax has taken on the mission to push for legislation to replace Georgia’s state income tax with a sales tax. GFFT expects to begin the process of developing the details and creating a specific state FairTax bill soon. Passage of our own state FairTax bill would boost our economy and entice those seeking lower taxes to look more closely at Georgia!

Michael Barone is senior political analyst for the Washington Examiner, co-author of The Almanac of American Politics and a contributor to Fox News.